Private Limited Company Registration in India – Complete Guide (2025)

Starting a Private Limited Company is one of the best ways to launch a serious, professional, and investor-friendly business in India. Whether you are a new founder or an experienced entrepreneur, this structure gives your business long-term strength and protects your personal assets. In this friendly guide, we’ll walk you through everything—like documents, eligibility, costs, timelines, compliance, and common founder mistakes—explained in simple words so you understand every step clearly.

With FilingPoint by your side, setting up your company becomes smooth, stress-free, and beautifully organised. This guide is designed to give you confidence and help you take the next step toward forming your dream company.

How to contact us? who we are?

What Is a Private Limited Company?

A Private Limited Company is a type of business registered under the Companies Act, 2013, which gives your business a separate legal identity. It means the company can operate on its own, enter agreements, and hold assets independent of the founders. This separation protects individuals and makes the business more reliable. Because this structure has strong legal backing, many entrepreneurs prefer it for security and professionalism.

Who Should Choose It?

Founders who want to run a scalable and organised business benefit the most from this structure. It is ideal for growing companies, service providers, tech startups, small manufacturers, and anyone looking to build a trustworthy brand. It works well for businesses that plan to register for GST, open a current account, or hire employees. FilingPoint helps such founders understand rules and register easily without confusion.

Why It’s Preferred by Investors & Banks

Investors prefer Private Limited Companies because the law clearly defines shareholding, ownership, and responsibilities. It becomes easier for them to invest, evaluate business value, and exit safely when required. Banks also trust this structure more because it shows strong documentation and compliance. For any business that wants to raise funds or build credibility, this structure becomes a perfect choice.

Benefits of Registering a Private Limited Company

Limited Liability

Limited liability protects your personal savings, home, and assets if something goes wrong in the business. Only the company’s assets are used to manage risks, which keeps your personal life safe. This gives founders the freedom to grow their business without fear of personal loss. It also encourages more people to start companies confidently. FilingPoint makes sure your structure is legally strong from day one.

Separate Legal Entity

A Private Limited Company is treated as a completely separate legal person. This means the company continues to function even if ownership or management changes. Such consistency helps business partners trust you more. It also increases professionalism and credibility with clients. FilingPoint ensures your documents clearly define how your company will function legally.

Easy Funding & Valuation

Investors, banks, and venture capital firms prefer investing in Private Limited Companies because the structure is transparent and structured. Shareholding is clearly defined, which makes valuation straightforward. If your business plans to grow fast or raise funds later, this structure supports you perfectly. FilingPoint helps create investor-friendly documents for smoother funding.

Perpetual Succession

A Private Limited Company continues existing even if a director or shareholder exits, retires, or passes away. This ensures long-term stability for clients, partners, and investors. It also protects the company from disruption due to personal changes. Because of this continuity, many businesses choose this structure for long-term planning. FilingPoint helps maintain your company records for smooth succession.

Reliable Brand Image

When your business is registered as a Private Limited Company, people automatically view it as trustworthy. It shows professionalism, reliability, and commitment. Clients and vendors often prefer working with registered companies because it reduces risk. This simple change immediately boosts your brand image. FilingPoint helps new founders establish a strong, legally recognised identity.

Eligibility Criteria for Private Limited Company Registration

Minimum Directors

A Private Limited Company must have at least two directors to start. One of them must be an Indian resident, which ensures legal compliance with Indian regulations. Directors play a major role in signing forms, managing operations, and representing the company. With the right director structure, your company functions smoothly from the beginning. FilingPoint helps you choose the correct director setup.

Minimum Shareholders

The company must have at least two shareholders, and both directors can also be shareholders. Shareholders own the company through shares, and their ownership percentage defines their voting rights. Proper planning of shareholding avoids conflicts in the future. FilingPoint guides founders in deciding a clear and fair shareholding pattern for long-term stability.

Residency Requirements

Indian law requires at least one director to stay in India for a minimum number of days each year. This ensures the company follows local rules and has a representative in the country. Residency plays an important role during compliance filings and approvals. FilingPoint ensures your director documents meet residency guidelines without confusion.

Authorised Capital Rules

Authorised capital refers to the maximum capital your company is legally allowed to raise. You don’t need to pay the full amount while registering—you only declare it. However, choosing an incorrect authorised capital can increase cost or compliance burden. FilingPoint helps founders select the right authorised capital that suits their business plans.

Documents Required for Private Limited Company Registration

Director KYC

Every director must submit basic KYC documents such as a PAN card, Aadhaar card, passport-size photo, and address proof. These documents prove the identity of directors and allow government to verify who is running the company. Clean and clear KYC helps the registration move faster without any rejections. Many delays happen when the documents are unclear or mismatched. FilingPoint checks every document generously before submission to avoid errors.

Office Address Proof

The company must have a registered office address where documents and notices can be sent. This address can be a home, rented office, or commercial space, as long as valid proof is available. A recent utility bill or rental agreement is usually enough for registration. The address is also used for future ROC filings and compliance records. FilingPoint ensures your address documents meet government rules perfectly.

NOC from the Property Owner

If you are using a rented or shared place as your registered office, you must get a No-Objection Certificate (NOC) from the owner. The NOC simply states that the owner allows the property to be used for business communication. Even home addresses require this letter to avoid objections later. Without the NOC, government may reject the form or ask for clarification. FilingPoint provides ready-to-use NOC templates for fast completion.

MoA / AoA Details

The Memorandum of Association (MoA) explains the purpose of your company, while the Articles of Association (AoA) contain internal rules. These documents define how your company will run and what activities it will perform. Proper drafting protects your rights and sets a clear direction for growth. Many founders find MoA/AoA confusing, which can cause mistakes. FilingPoint prepares clean, professional documents to ensure smooth approval.

Sample Document Templates

Founders often feel stressed about formats, declarations, and supporting documents. Having proper templates makes the process faster and more organised. Templates help avoid spelling mistakes, formatting errors, and missing lines that cause rejections. FilingPoint provides ready-made templates for board resolutions, declarations, consents, and NOC letters. This saves time and helps your company get registered without complications.

Step-by-Step Registration Process

1. Name Availability

Filingpoint is help to apply your company in government side. We always checks both government and trademark records to avoid rejection. A well-planned name saves time and avoids repeated filings. A clean and unique name increases the chance of approval and helps build a strong brand. Many names get rejected because founders check only Google and Social Media

2. Digital Signature

FilingPoint register your DSC in quickly and guides you through the verification process. Every director must obtain a Digital Signature Certificate (DSC) to sign forms online. The DSC ensures that all signatures are secure, verified, and accepted legally by government. Without DSC, you cannot complete any company filings. Getting your DSC early speeds up the entire registration process. with filingpoint

3. Incorporation Account Setup

At FilingPoint, once the DSC is ready, the next step is logging into the Government’s company registration portal and opening the online incorporation application.

This powerful application handles everything — from name approval to PAN/TAN allocation — and is divided into multiple sections that must be filled with care. Any missing or incorrect information can lead to delays in approval.

FilingPoint completes the entire incorporation application accurately, ensuring founders stay stress-free and never worry about technical issues.

4. Name Approval

Part A of SPICe+ is used only for name reservation. You can submit one or two name options to the government for approval. Once government approves the name, it stays reserved for a specific period for your registration. If the name follows rules and is unique, approval comes quickly. FilingPoint helps you choose names that are meaningful, creative, and compliant with government rules.

5. Fill Company & Capital Details

FilingPoint prepares every detail, checks for errors, and ensures that the company structure is perfect for future growth. includes the most important information such as business activities, registered office address, director details, and share capital structure. All documents must match the details exactly for government to accept the filing. This is the most sensitive part of the process and requires careful planning.

6. Attach MoA & AoA

After filling the form, the MoA and AoA must be digitally attached. These documents define the rights, powers, and responsibilities of the company and its members. Well-written MoA and AoA help avoid internal conflicts and clarify business activities. These documents must match your business goals and legal requirements. FilingPoint drafts MoA/AoA in clean language that government easily approves.

7. Apply for PAN & TAN Automatically

One of the best features of SPICe+ is that PAN and TAN are generated automatically during registration. You don’t need a separate application or separate processing. This reduces time and paperwork for new businesses. Once approved, your PAN and TAN will appear on your Certificate of Incorporation. FilingPoint ensures all details are correct for smooth generation.

8. Certificate of Incorporation Issued

Once government verifies all forms, your Certificate of Incorporation (COI) is issued. The COI contains important details like the company name, CIN number, PAN, TAN, and date of registration. This certificate is solid proof that your company is now legally formed. With this certificate, you can open a bank account, apply for GST, and start operations. FilingPoint handles all post-incorporation steps so you can begin business immediately.

Private Limited Company Registration Fees

Government Fees

Government fees depend on authorised capital and vary for different states. These fees include approval charges for Forms and the Certificate of Incorporation. They ensure that your company is officially recognised under Indian law. Different capital levels may change the government fee slightly. FilingPoint helps founders choose the most suitable capital to keep fees reasonable.

Stamp Duty (State-Wise)

Stamp duty is charged by each state and applies to MoA, AoA, and other registration documents. Some states have high stamp duty, while others keep it moderate. This duty is unavoidable because it legally validates your incorporation papers. Choosing the right authorised capital helps optimise stamp duty. FilingPoint calculates the exact stamp duty based on your location and guides you properly.

Digital Signature Fee

Every director must have a DSC, and this comes with a small cost depending on validity and provider. DSC is essential because all filings are digital, and government accepts only secure signatures. Keeping DSC active ensures all future forms are filed smoothly. Missing or expired DSCs often cause delays. FilingPoint ensures quick and correct DSC processing.

Professional Fees

Many founders prefer expert help to avoid mistakes, resubmissions, and delays. Professional fees vary based on document preparation, drafting, and the level of assistance required. FilingPoint provides smooth, end-to-end assistance for founders who want fast, error-free registration. With guided support, documents stay clean and compliant from the beginning.

Timeline – How Many Days It Takes?

Normal Processing Time

In normal cases, company registration takes anywhere between a few working days based on how quickly documents are ready. The flow includes DSC, name approval, Form filing, and government review. When everything is accurate, the process moves smoothly without delays. FilingPoint ensures your paperwork is ready early so government approval happens faster.

Quick Mode

If all documents are clear and founders respond quickly, approval becomes much faster. The government typically responds quickly when documents match perfectly. This is why professional guidance plays an important role in fast registrations. FilingPoint supports founders who want urgent incorporation with zero errors.

Common Delays & How to Avoid Them

Delays normally occur due to document mismatches, unclear KYC, poor-quality scans, or incorrect capital selection. These simple mistakes can cause government to ask for resubmission, slowing the entire process. Having professionals review your application avoids these issues completely. FilingPoint checks every detail to eliminate chances of delay.

Post-Incorporation Mandatory Registrations

GST Registration

Once your company is incorporated, you may need to apply for GST depending on your business activity and turnover. Even if it’s not mandatory immediately, many clients and vendors prefer working with GST-registered companies. Having GST lets you issue proper tax invoices and build professional credibility. It also prepares you for future expansion. FilingPoint helps founders complete GST registration smoothly without confusion.

MSME Registration

MSME registration is a simple online process that helps small businesses receive benefits like priority lending, government schemes, and vendor trust. Even service-based companies and startups qualify for MSME status. It acts as a badge of recognition that your company is part of India’s fast-growing small business sector. Registering early ensures you never miss future benefits. FilingPoint assists you with a clean and fast MSME application.

Bank Account Opening

A dedicated current account is required to perform all business transactions legally. Once your Certificate of Incorporation, PAN, and address proof are ready, opening the account is quick and easy. A separate account keeps personal and business expenses cleanly divided. This helps during audits, compliance checks, and financial management. FilingPoint provides all required documents so you can open your account without any hurdles.

Books of Accounts Setup

Right after incorporation, companies must maintain accurate books of accounts. These records track income, expenses, assets, and liabilities. Clean accounts help avoid tax issues and make ROC filings easy. Many founders ignore this step at the start and face problems later. FilingPoint provides accounting support so your records start clean from day one.

Auditor Appointment (ADT-1 Filing)

Companies must appoint a statutory auditor within the prescribed time after incorporation. The auditor examines financial statements and ensures legal accuracy. Appointing an auditor early prevents compliance gaps and future penalties. ADT-1 filing is mandatory for confirming the appointment. FilingPoint handles auditor onboarding and ADT-1 filing professionally.

Compliance Checklist After Registration

Board Meetings

Every company must hold board meetings to record important decisions and maintain transparency. These meetings help directors discuss financial matters, business plans, and important updates. Proper minutes must be prepared and stored as part of compliance records. Ignoring board meetings can create future issues regarding governance. FilingPoint helps you maintain clean and well-structured meeting records.

ROC Filings

ROC filings include forms that report your company’s annual activities and financial position. These filings are mandatory for all companies, regardless of size or turnover. Missing ROC filings can lead to legal complications. Proper and timely filings ensure your company remains in good standing with government. FilingPoint manages your filings accurately and on time.

Annual Return Filing

The annual return contains details about shareholders, directors, meetings, and share structure. It gives government a complete picture of your company’s status. Filing it every year ensures transparency and compliance with the law. Annual returns must be accurate and consistent with your records. FilingPoint prepares and submits your return with complete attention to detail.

Income Tax Filing

A company must file income tax returns even if it has zero turnover. The filing includes income details, expenses, and tax calculations. Timely filing prevents notices and unnecessary complications. Clean tax records help build trust during audits and funding rounds. FilingPoint ensures your tax returns are filed correctly and confidently.

TDS Compliance

Companies must deduct TDS on payments such as salaries, contracts, professional fees, and more. After deducting TDS, companies must file quarterly returns summarizing these payments. Proper TDS compliance shows financial discipline. Missing TDS filings can create mismatches and trouble during audits. FilingPoint manages your TDS deductions and returns without stress.

Common Mistakes Founders Make During Registration

Choosing the Wrong Authorised Capital

FilingPoint helps founders decide the perfect authorised capital based on their goals. Many founders select authorised capital without understanding how it affects costs and compliance. Choosing too high may increase stamp duty, while choosing too low may limit growth. The right value should match your company’s future plans without unnecessary burden. Proper planning saves both time and effort.

Selecting Unavailable or Non-Compliant Names

FilingPoint conducts deep checks to help you avoid name rejection. Company names often get rejected because they sound similar to existing companies or registered trademarks. Founders sometimes check only Google instead of government and trademark databases. A rejected name causes delays and additional work. Choosing unique, clear, and compliant names increases approval chances immediately.

No NOC from Landlord

Founders often forget to collect the NOC for the registered office, especially when using a home or shared space. Without the NOC, government may reject the address proof or request clarifications. This slows down registration and causes repeated submissions. A simple signed NOC solves the entire issue. FilingPoint provides easy NOC formats that landlords can sign quickly.

Mismatch in KYC Documents

FilingPoint checks every document thoroughly before uploading to forms. If documents like PAN, Aadhaar, or address proof have different spellings or outdated details, government rejects the application. Even small issues like old addresses or unclear scans cause delays. Ensuring perfect documentation avoids re-filing and speeds up approval.

Confusion Between Residential & Commercial Addresses

Many founders think they need a commercial office address, which is not true. Registered offices can be homes, rented rooms, small offices—anything with proper proof. This simple misunderstanding makes founders unnecessarily search for new space. FilingPoint clarifies the rules and helps prepare the right documents for any location.

Detailed Comparison Tables

1. Eligibility Comparison Table

Private Limited Companies offer the most growth flexibility, making them ideal for expanding businesses and startups. LLPs are great for professional partners who want structure but with less compliance. OPC suits solo founders who want legal protection without needing partners. Foreign shareholding is unrestricted in Pvt Ltd and LLP but not in OPC. FilingPoint helps founders choose the right structure based on goals.

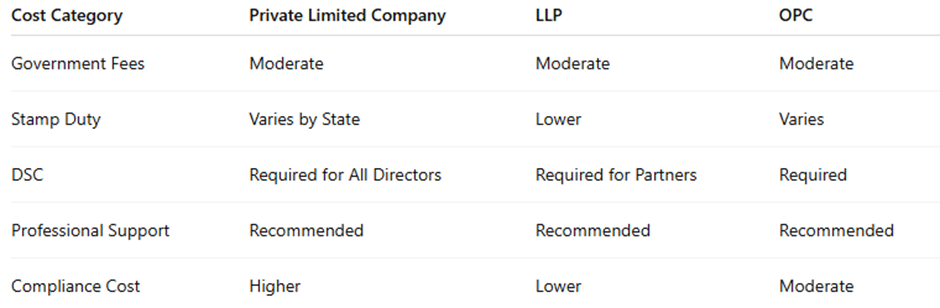

2. Detailed Cost Comparison Table

The cost of registration depends on capital, state stamp duty, and number of directors or partners. Private Limited Companies generally have slightly higher compliance effort because of detailed filings. LLPs have simpler compliance requirements, making ongoing cost lower. OPC costs are moderate because only one person manages everything. FilingPoint explains all hidden factors clearly so you choose wisely.

3. Timeline Table

| Days | Stage |

| Day 1–2 | DSC Application & Approval |

| Day 3–4 | Name Approval through SPICe+ Part A |

| Day 5–9 | Filling SPICe+ Part B + Attachments |

| Day 10–12 | government Review & Certificate of Incorporation |

| Post-COI | Bank Account + GST + MSME + Auditor Appointment |

The entire process moves smoothly when documents are clean and founders respond quickly. DSC usually gets approved first, followed by name reservation. Once the name is approved, SPICe+ filing becomes the main step that requires care. government then reviews and approves the incorporation, issuing your COI. FilingPoint helps complete all post-incorporation steps the same week.

FAQs

1. What is a Private Limited Company in simple words?

A Private Limited Company is a registered business that has its own legal identity separate from the owners. It can buy assets, sign contracts, and operate independently. This structure protects your personal assets from business risks. People trust this model because it is organised and legally strong. FilingPoint helps you set it up easily with clean documentation.

2. How many directors are required to start a Private Limited Company?

You need at least two directors to register the company. Both directors must provide KYC documents and one must be a resident of India. Directors take part in decision-making and represent the company legally. A proper director structure makes operations smooth and transparent. FilingPoint helps you meet all requirements correctly.

3. Can one person start a Private Limited Company?

No, one person cannot start a Private Limited Company because two members are required. However, a single founder can start an OPC (One Person Company). OPC offers many of the same protections but is designed for solo entrepreneurs. Later, if needed, OPC can be converted into a Private Limited Company. FilingPoint guides founders on the best structure based on their plans.

4. Can NRIs and foreign nationals be directors or shareholders?

Yes, NRIs and foreign nationals can become directors or shareholders easily. They only need to provide their passport and foreign address proof. At least one director must still be an Indian resident to meet legal rules. Many global founders choose Indian companies for expansion. FilingPoint handles all cross-border documentation without stress.

5. What is the minimum capital required to start?

There is no fixed minimum capital needed to register a Private Limited Company. You can start with any reasonable amount that matches your business goals. Capital can be increased later when your company grows. This flexibility helps small founders start without pressure. FilingPoint helps you choose the right capital for long-term planning.

6. How many days does the entire registration process take?

The whole process usually takes a few working days if all documents are ready. DSC, name approval, and filing SPICe+ happen in sequence. government approval comes after checking your documents and structure. Delays happen only if documents are unclear or mismatched. FilingPoint ensures smooth and fast approval by preparing everything correctly.

7. Can I use my home as the registered office of the company?

Yes, you can use your home address as the registered office without any issue. You only need a recent utility bill and an NOC from the property owner. Many startups begin from home to reduce early expenses. This does not affect your company’s professionalism or growth. FilingPoint prepares all documents to match government requirements.

8. What if the company name I want gets rejected?

If your proposed name is similar to an existing company or trademark, government will reject it. You must then propose new names that follow the naming rules. Rejected names slow down the process and create extra work. This is why checking government and trademark databases is important. FilingPoint does deep name research to avoid rejections.

9. Is GST compulsory for a new Private Limited Company?

No, GST is not compulsory unless your business crosses the turnover threshold or deals in specific goods/services. However, some clients and vendors prefer GST-registered companies for billing. Having GST early can increase credibility and business opportunities. FilingPoint helps you decide the right time to apply. It’s easy and fully online.

10. What is SPICe+ and why is it important?

SPICe+ is an online form used by government to register companies in India. It covers name approval, incorporation, PAN, TAN, and many more services in one place. This saves time and avoids multiple filings. SPICe+ makes the registration process smooth and organised. FilingPoint handles the entire SPICe+ filing for hassle-free approval.

11. Do all directors need a DSC?

Yes, every director signing the forms must have a valid Digital Signature Certificate. DSC ensures secure and legally accepted digital signing for all government filings. Without DSC, the registration cannot proceed. Keeping DSC updated is also important for future filings. FilingPoint arranges DSC quickly for all directors.

12. Can directors be changed after incorporation?

Yes, you can add or remove directors anytime after incorporation. Proper board resolutions and government filings must be completed for changes to be valid. This flexibility helps companies adapt as they grow. Many startups restructure their teams later. FilingPoint manages director changes smoothly with proper documentation.

13. Is it mandatory to appoint an auditor within the first month?

Yes, appointing a statutory auditor is compulsory within the prescribed time after incorporation. The auditor checks your financials and ensures legal accuracy. Early appointment keeps your company compliant from day one. Missing this step may cause compliance issues later. FilingPoint handles ADT-1 filing and helps you appoint the right auditor.

14. What annual compliances does a Private Limited Company need to follow?

Companies must file annual returns, financial statements, income tax returns, and maintain books of accounts. They must also conduct board meetings and follow TDS rules. These tasks ensure the company remains legally clean and transparent. Proper compliance protects your business from penalties. FilingPoint manages all compliance work with consistency.

15. What are the most common mistakes founders make?

Founders often choose incorrect authorised capital, submit unclear KYC documents, or propose names that do not meet government rules. These issues delay approval and cause repeated filings. Many forget to take an NOC from the property owner or misunderstand address rules. All these problems are easily avoidable with proper guidance. FilingPoint ensures a smooth, mistake-free registration.

16. Can I raise funds easily after incorporating a Private Limited Company?

Yes, this structure is the most investor-friendly in India. Investors trust companies that have organised shareholding, clean documentation, and legal stability. Private Limited Companies support issue of shares, valuations, and share transfers. This makes fundraising simple and flexible. FilingPoint prepares your company for investor readiness from the beginning.

17. What documents are required for the registered office?

You need an address proof such as a utility bill, rental agreement, and a signed NOC from the owner. These documents confirm that you legally use the address for business purposes. Residential and commercial spaces are both allowed. Clean and clear documents speed up registration. FilingPoint checks every document carefully to avoid rejections.

Conclusion

Starting a Private Limited Company is one of the strongest steps you can take as a founder in India. It gives your business structure, safety, professionalism, and long-term stability. Whether you are starting from home or planning a large venture, this model supports your growth at every stage. With simple requirements and a clear process, anyone can build a strong legal foundation.

With FilingPoint, your entire registration journey becomes smooth, supportive, and stress-free. Our team guides you with clean documentation, friendly explanations, and accurate filing. When your foundation is strong, your business grows with confidence. You are now ready to take the next step and bring your dream company to life.

3 thoughts on “Private Limited Company Registration: Step-by-Step Guide (Cost, Documents, Timeline – 2025 Update)”

Comments are closed.